E–invoicing, also known as electronic invoicing, is gaining popularity in the business-to-government and business-to-business sectors worldwide, eventually replacing the traditional paper invoice and the more current PDF invoice.

The public sector will shift towards e-invoicing in Australia by 1st July 2022. Australian federal government agencies must adopt e-invoicing. The Australian also strongly recommends state governments/agencies adopt e-invoicing.

Moreover, cloud ERP systems assist in reaching new heights of invoice processing performance. Digitizing invoices may decrease supplier questions, speed up approvals, and increase compliance.

What Does Electronic invoicing Entail?

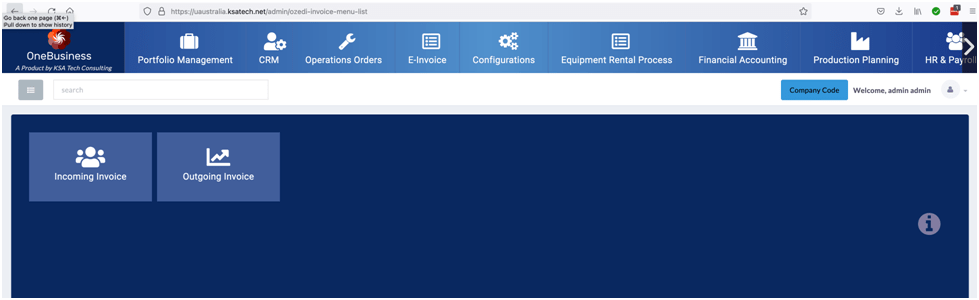

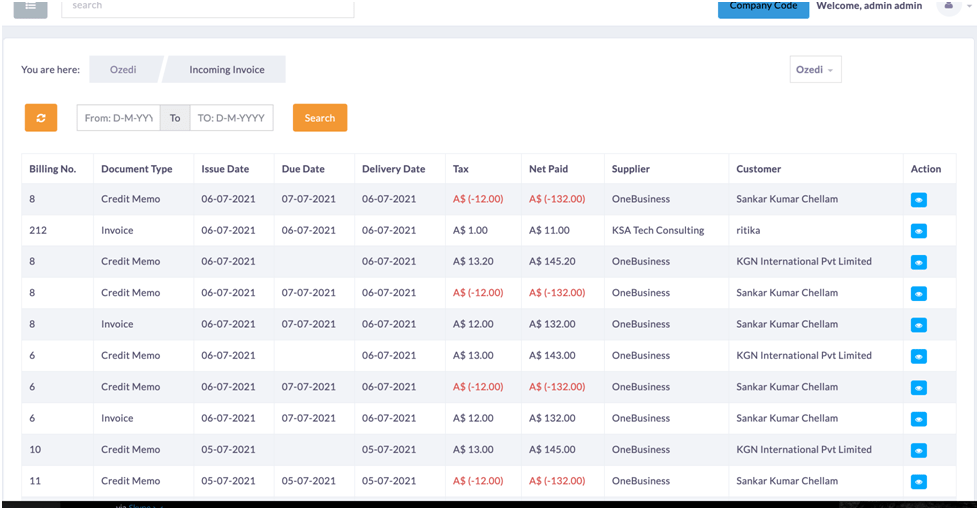

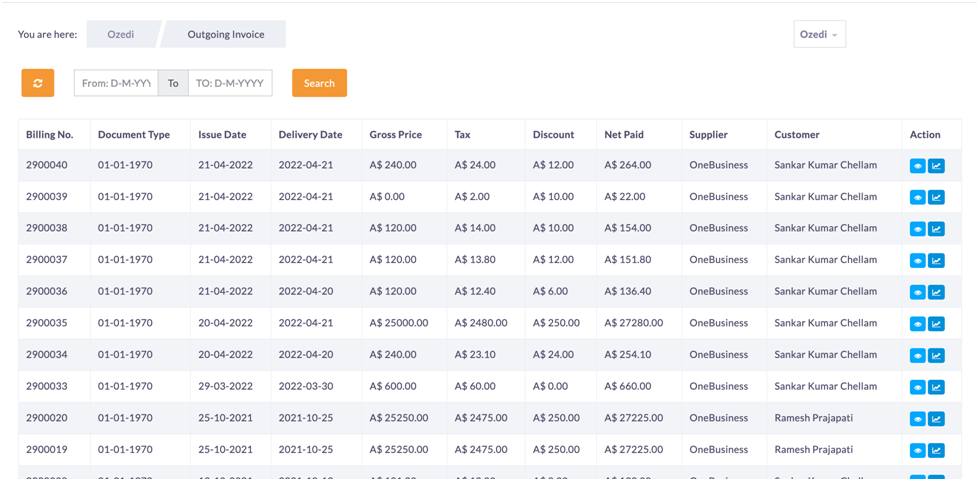

Invoicing is a kind of billing in which the invoice is delivered to the customer in an electronic format via a predetermined structured data exchange protocol. The Illustration below uses the OneBusiness ERP e-invoicing feature with Ozedi Australia as a third-party intermediate provider for the Peppol APN interface.

When we send an electronic invoice,we store the invoice data in a structured format and immediately process it using the purchasing organization’s accounting system or purchasing software. Furthermore, they contain critical purchase data for verification and the invoice date. However, the system will process the invoice verification in the background.

The use of invoices necessitates the performance of two critical functions:

1. The proper structure must be used when creating the e-invoice. For example, Peppol stipulates the international data format.

2. The process transfers the electronic invoice from the seller’s software to the purchaser’s system through Peppol APN.

Because of its efficiency and scalability for all parties concerned, the network model is most widely utilized today in areas where e-invoicing is likely to increase.

Note: The image display above uses dummy data for Illustration.

Fig:1 Incoming Invoices

Fig:2 Outgoing Invoices

Note: The image display above uses dummy data for Illustration.

Benefits

E-invoicing has several benefits for every business. You must have accounting software ready with this feature.

Here are some of them:

Save Time& Money

Many unneeded stages are eliminated from the billing process when using e-invoicing Australia. With online e-invoicing software, you and your client may save time on both sides of the transaction.For example, a standard invoice processing using a conventional paper-based invoice will cost AUD27. At the same time, an invoice will cost AUD 3 per invoice. The figures may not be accurate but are indicative and promise to yield returns to every organization.

Error Reduction

By automating the invoicing process on an ongoing basis and eliminating the need for human intervention, we can minimize input mistakes to an absolute bare minimum

Get Paid Faster

The e-invoice may be sent to the client as soon as possible. In addition, paying an electronic invoice requires less work and less time. As a result, the consumer is more likely to make a quicker payment.

Keep Track of Invoices Easier

Using e-invoicing software, you can track when an invoice has been paid, viewed, and delivered. Then, when the invoice is dispatched and accepted, you will know that it has been received. Using the process, a vendor sends structured data and provides it to Peppol APN. Then, the Peppol HUB delivers the invoice to the right customer’s system. As a result, the chances of delays are almost nil.

Increase Data Integrity

From the buyer’s standpoint, e-invoicing Australia lessens the likelihood of receiving fake bills. This perception is because when sending an e-invoice, the legitimacy of the invoices is automatically verified.

Reduce Costs

You don’t have to pay for paper or postage with paperless invoicing. Furthermore, you save working time by utilizing e-invoicing instead of templates and sending PDFs. Instead, focus on other jobs that offer value. We’re all aware that time is money!

Offer Better Client Service

It will be handier if your consumer receives an e-invoice to their preferred platform. It is possible to save up to 90% on processing expenses by receiving an e-invoice instead of a paper invoice. In addition, your client will have more opportunities to benefit from early payment discounts if the delivery time is shorter, which will also grow when the shipping time is faster.

E-invoicing is rapidly becoming the usual, particularly in the business-to-business (B2B) world. You could always start e-invoicing now since your consumers will want it someday. Moreover, several businesses have already refused to accept invoices in any other format.

E-invoicing XML format:

<?xml version="1.0" encoding="UTF-8"?> <Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2"> <cbc:CustomizationID>urn:cen.eu:en16931:2017#conformant#urn:fdc:peppol.eu:2017:poacc:billing:international:aunz:3.0</cbc:CustomizationID> <cbc:ProfileID>urn:fdc:peppol.eu:2017:poacc:billing:01:1.0</cbc:ProfileID> <cbc:ID>22</cbc:ID> <cbc:IssueDate>2021-10-25</cbc:IssueDate> <cbc:DueDate>2021-10-26</cbc:DueDate> <cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode> <cbc:Note>bhjkl</cbc:Note> <cbc:DocumentCurrencyCode>AUD</cbc:DocumentCurrencyCode> <cbc:AccountingCost>Notes not valid</cbc:AccountingCost> <cbc:BuyerReference>Krisoth</cbc:BuyerReference> <cac:OrderReference> <cbc:ID>PurchaseOrderReference</cbc:ID> <cbc:SalesOrderID>123496</cbc:SalesOrderID> </cac:OrderReference> <cac:AccountingSupplierParty> <cac:Party> <cbc:EndpointID schemeID="0151">72157708720</cbc:EndpointID> <cac:PartyIdentification> <cbc:ID schemeID="0151">72157708720</cbc:ID> </cac:PartyIdentification> <cac:PartyName> <cbc:Name>OneBusiness</cbc:Name> </cac:PartyName> <cac:PostalAddress> <cbc:StreetName>88 Moonlight avenue</cbc:StreetName> <cbc:AdditionalStreetName>testing</cbc:AdditionalStreetName> <cbc:CityName>Belconnen</cbc:CityName> <cbc:PostalZone>6785</cbc:PostalZone> <cac:Country> <cbc:IdentificationCode>AU</cbc:IdentificationCode> </cac:Country> </cac:PostalAddress> <cac:PartyTaxScheme> <cbc:CompanyID>72157708720</cbc:CompanyID> <cac:TaxScheme> <cbc:ID>GST</cbc:ID> </cac:TaxScheme> </cac:PartyTaxScheme> <cac:PartyLegalEntity> <cbc:RegistrationName>OneBusiness</cbc:RegistrationName> <cbc:CompanyID schemeID="0151">72157708720</cbc:CompanyID> </cac:PartyLegalEntity> <cac:Contact> <cbc:Name>Sankar</cbc:Name> <cbc:Telephone>0410348345</cbc:Telephone> <cbc:ElectronicMail>tester9065@gmail.com</cbc:ElectronicMail> </cac:Contact> </cac:Party> </cac:AccountingSupplierParty> <cac:AccountingCustomerParty> <cac:Party> <cbc:EndpointID schemeID="0151">98123</cbc:EndpointID> <cac:PartyIdentification> <cbc:ID schemeID="0151">98123</cbc:ID> </cac:PartyIdentification> <cac:PartyName> <cbc:Name>Krisoth</cbc:Name> </cac:PartyName> <cac:PostalAddress> <cbc:StreetName>No 3, Venket Nagar, Kolathur</cbc:StreetName> <cbc:AdditionalStreetName>Notes not valid</cbc:AdditionalStreetName> <cbc:CityName>Abiramam</cbc:CityName> <cbc:PostalZone>600099</cbc:PostalZone> <cac:Country> <cbc:IdentificationCode>IN</cbc:IdentificationCode> </cac:Country> </cac:PostalAddress> <cac:PartyTaxScheme> <cbc:CompanyID>98123</cbc:CompanyID> <cac:TaxScheme> <cbc:ID>GST</cbc:ID> </cac:TaxScheme> </cac:PartyTaxScheme> <cac:PartyLegalEntity> <cbc:RegistrationName>OneBusiness</cbc:RegistrationName> <cbc:CompanyID schemeID="0151">98123</cbc:CompanyID> </cac:PartyLegalEntity> <cac:Contact> <cbc:Name>Krisoth</cbc:Name> <cbc:Telephone>7894561230</cbc:Telephone> <cbc:ElectronicMail>Krish@gm.com</cbc:ElectronicMail> </cac:Contact> </cac:Party> </cac:AccountingCustomerParty> <cac:Delivery> <cbc:ActualDeliveryDate>2021-10-25</cbc:ActualDeliveryDate> <cac:DeliveryLocation> <cbc:ID schemeID="0151">0151</cbc:ID> <cac:Address> <cbc:StreetName>test</cbc:StreetName> <cbc:AdditionalStreetName>test</cbc:AdditionalStreetName> <cbc:CityName>Eshkashem</cbc:CityName> <cbc:PostalZone>1234</cbc:PostalZone> <cac:Country> <cbc:IdentificationCode>AF</cbc:IdentificationCode> </cac:Country> </cac:Address> </cac:DeliveryLocation> <cac:DeliveryParty> <cac:PartyName> <cbc:Name>Krisoth</cbc:Name> </cac:PartyName> </cac:DeliveryParty> </cac:Delivery> <cac:PaymentMeans> <cbc:PaymentMeansCode name="EFT">31</cbc:PaymentMeansCode> <cbc:PaymentID>22</cbc:PaymentID> <cac:PayeeFinancialAccount> <cbc:ID>12345678</cbc:ID> <cbc:Name>Advanced Bakery Services Pty Ltd</cbc:Name> <cac:FinancialInstitutionBranch> <cbc:ID>034655</cbc:ID> </cac:FinancialInstitutionBranch> </cac:PayeeFinancialAccount> </cac:PaymentMeans> <cac:PaymentTerms> <cbc:Note>Payable within 1 calendar month from the invoice date</cbc:Note> </cac:PaymentTerms> <cac:AllowanceCharge> <cbc:ChargeIndicator>false</cbc:ChargeIndicator> <cbc:AllowanceChargeReason>IS</cbc:AllowanceChargeReason> <cbc:Amount currencyID="AUD">0.00</cbc:Amount> <cac:TaxCategory> <cbc:ID>S</cbc:ID> <cbc:Percent>10.00</cbc:Percent> <cac:TaxScheme> <cbc:ID>GST</cbc:ID> </cac:TaxScheme> </cac:TaxCategory> </cac:AllowanceCharge> <cac:TaxTotal> <cbc:TaxAmount currencyID="AUD">2475.00</cbc:TaxAmount> <cac:TaxSubtotal> <cbc:TaxableAmount currencyID="AUD">25250.00</cbc:TaxableAmount> <cbc:TaxAmount currencyID="AUD">2475.00</cbc:TaxAmount> <cac:TaxCategory> <cbc:ID>S</cbc:ID> <cbc:Percent>10.00</cbc:Percent> <cac:TaxScheme> <cbc:ID>GST</cbc:ID> </cac:TaxScheme> </cac:TaxCategory> </cac:TaxSubtotal> </cac:TaxTotal> <cac:LegalMonetaryTotal> <cbc:LineExtensionAmount currencyID="AUD">25250.00</cbc:LineExtensionAmount> <cbc:TaxExclusiveAmount currencyID="AUD">25250.00</cbc:TaxExclusiveAmount> <cbc:TaxInclusiveAmount currencyID="AUD">27225.00</cbc:TaxInclusiveAmount> <cbc:AllowanceTotalAmount currencyID="AUD">0.00</cbc:AllowanceTotalAmount> <cbc:ChargeTotalAmount currencyID="AUD">0.00</cbc:ChargeTotalAmount> <cbc:PayableAmount currencyID="AUD">27225.00</cbc:PayableAmount> </cac:LegalMonetaryTotal> <cac:InvoiceLine> <cbc:ID>22</cbc:ID> <cbc:InvoicedQuantity unitCode="EA">1.00</cbc:InvoicedQuantity> <cbc:LineExtensionAmount currencyID="AUD">25000.00</cbc:LineExtensionAmount> <cac:OrderLineReference> <cbc:LineID>22</cbc:LineID> </cac:OrderLineReference> <cac:Item> <cbc:Description>e5eytytt</cbc:Description> <cbc:Name>IPHONE</cbc:Name> <cac:StandardItemIdentification> <cbc:ID schemeID="0151">0</cbc:ID> </cac:StandardItemIdentification> <cac:OriginCountry> <cbc:IdentificationCode>AU</cbc:IdentificationCode> </cac:OriginCountry> <cac:CommodityClassification> <cbc:ItemClassificationCode listID="BH">0</cbc:ItemClassificationCode> </cac:CommodityClassification> <cac:ClassifiedTaxCategory> <cbc:ID>S</cbc:ID> <cbc:Percent>10.00</cbc:Percent> <cac:TaxScheme> <cbc:ID>GST</cbc:ID> </cac:TaxScheme> </cac:ClassifiedTaxCategory> </cac:Item> <cac:Price> <cbc:PriceAmount currencyID="AUD">25000.00</cbc:PriceAmount> </cac:Price> </cac:InvoiceLine> </Invoice>