Accounts Receivable Tracking- OneBusiness ERP

Accounts receivable management is an essential factor in many businesses. In this field, the effective use of accounts receivable processing software can make a huge difference for companies. The processing systems enable companies to manage their customers, collect payments and reduce bad debt levels in a timely and efficient manner. Companies that use strong accounts receivable tracking management systems can increase the profitability of their businesses.

ERP systems can improve the management of your company’s accounts receivable by making it easier to process customer transactions. Most companies use accounts receivable management software to manage their customers’ transactions and keep track of their unpaid invoices. This method lets managers focus on other tasks without forgetting important details about customer transactions. Doing so helps improve customer relations and increase company profits. In addition, customers appreciate companies that make it easy for them to pay their bills without delay. A robust system also prevents bad debts from negatively affecting the business’s credit rating. Failing to do so can lead to costly bank intervention or lawsuits from unpaid clients.

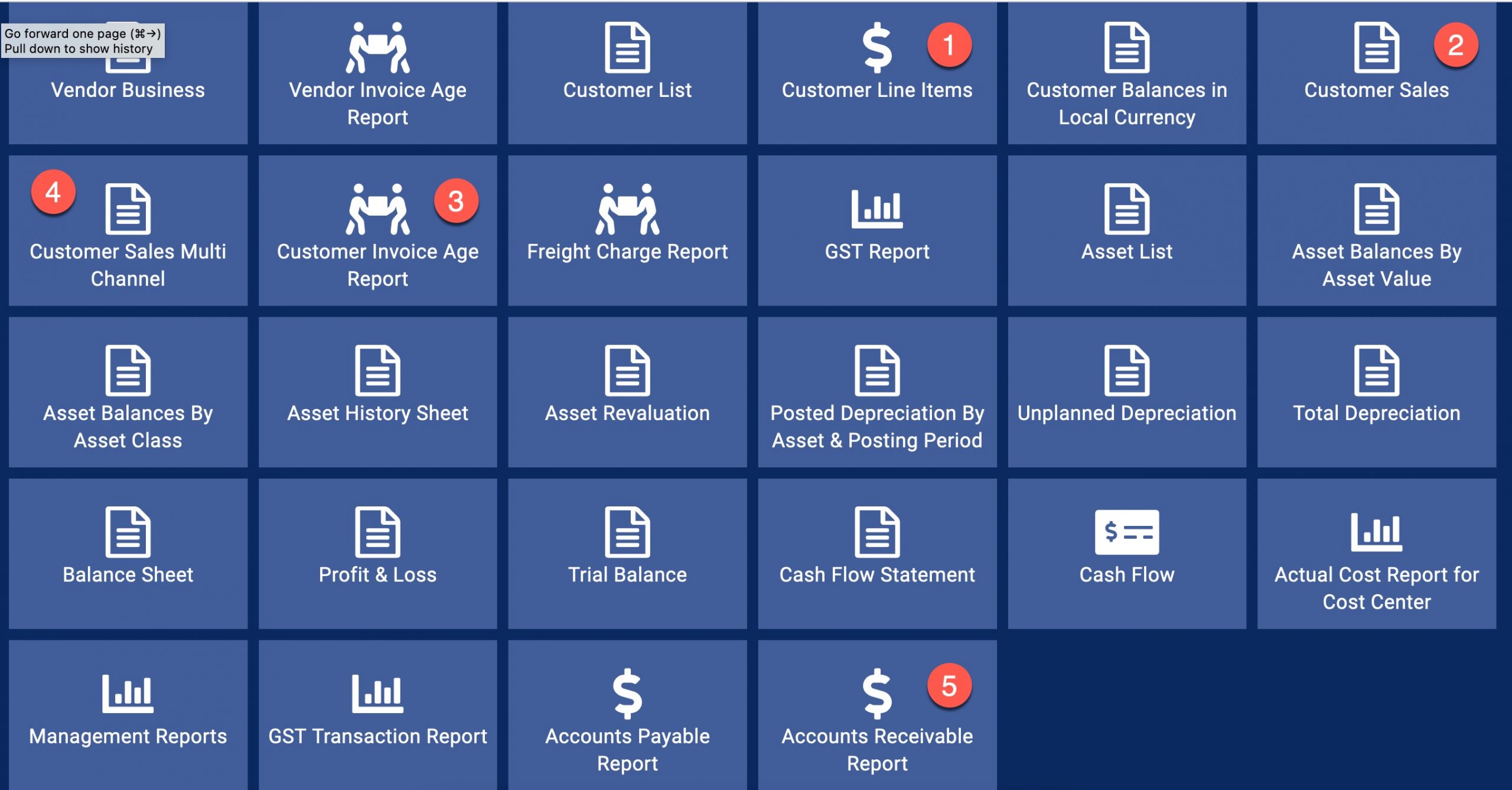

OneBusiness ERP Accounts payable tracking reports

OneBusiness ERP Accounts payable tracking reports

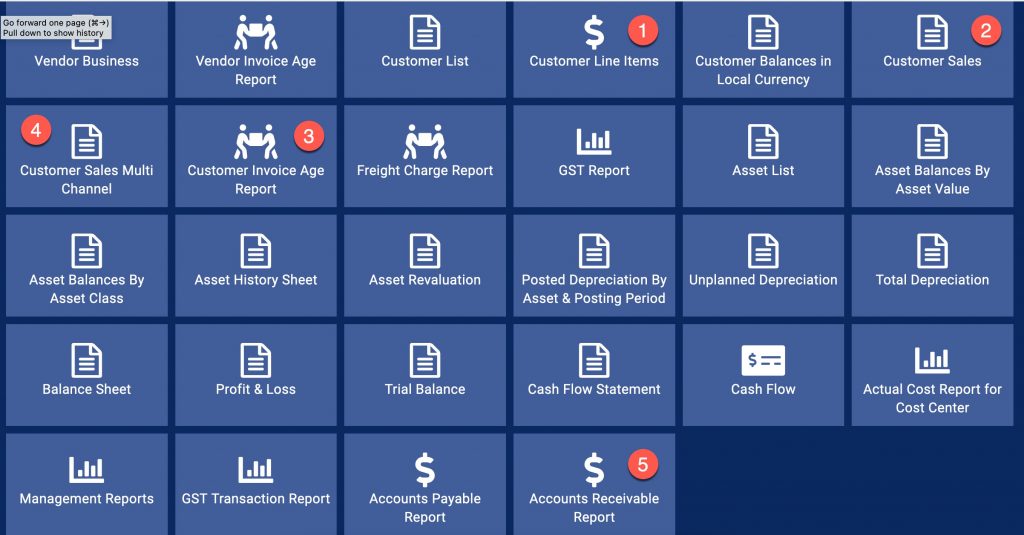

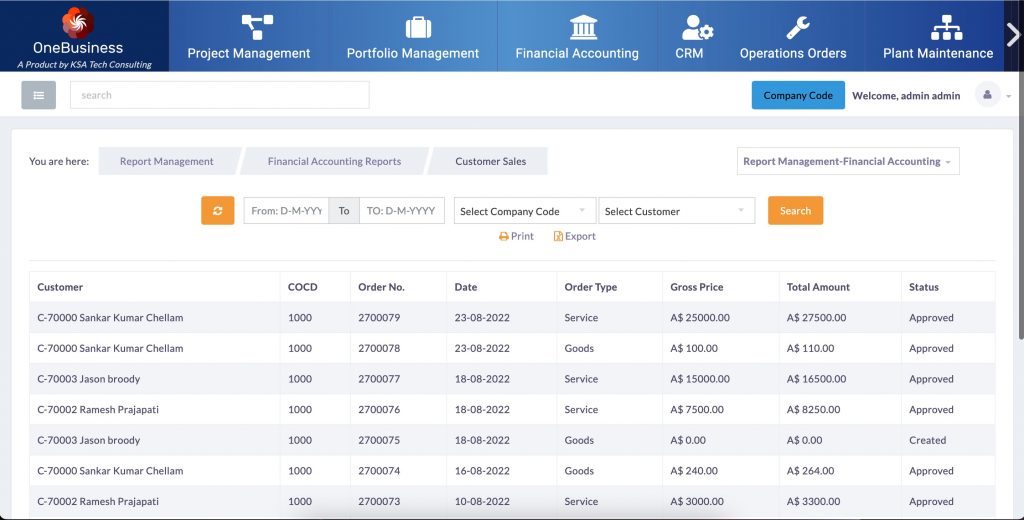

The customer items report shows all sales by customer:

Accounts payable tracking report-1

Accounts payable tracking report-1

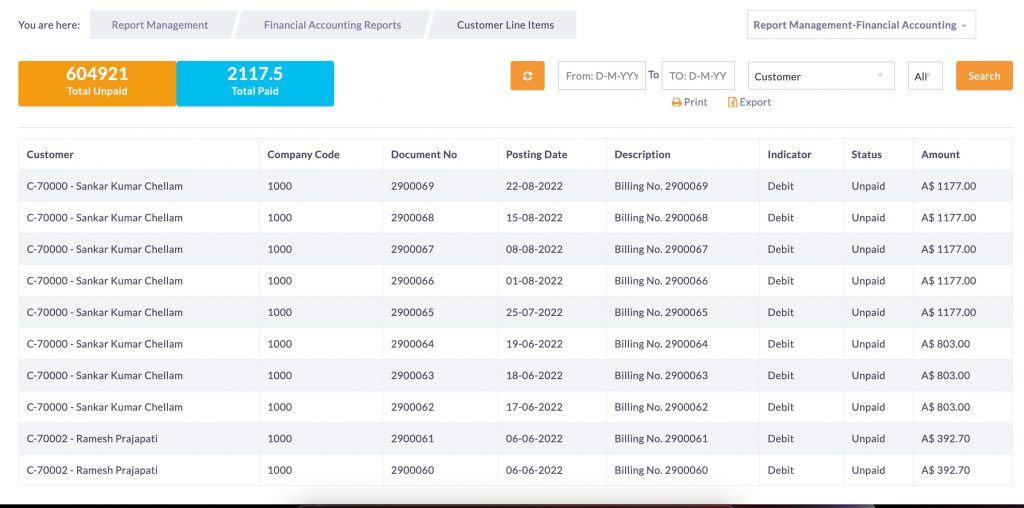

Customer sales report showing order details.

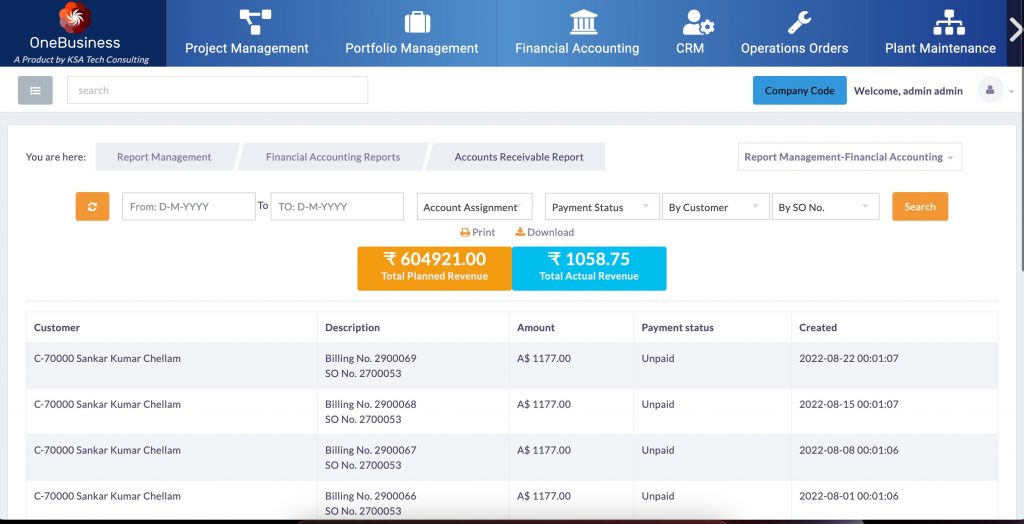

Accounts receivable report-2

Accounts receivable report-2

Accounts receivable report with invoice and payment status

Accounts Receivable report-3

Accounts Receivable report-3

Effective accounts receivable tracking management software typically improves your company’s collection rate from your customers. Many businesses find it difficult to collect payments from customers when they don’t have an accurate record of transactions. This is because old-fashioned ledgers often show some transactions as having occurred when they didn’t— creating an outstanding balance on the books. As a result, clients owe outstanding balances money with no way of clearing them since no one knows about the old records anymore. In addition, companies with weak accounting systems often find themselves behind on payments due to old unpaid invoices or sloppy collection procedures. More robust systems help managers focus on collecting outstanding debts instead of letting them accumulate further into company coffers.

Companies with weak accounting systems often find themselves at a disadvantage when managing their accounts receivable tracking. This happens if they have no way of monitoring unpaid invoices accurately through old-fashioned bookkeeping methods. Other applications for such software include time tracking, payroll processing and job costing functions — all crucial aspects required by any credible business operating with employees.