Accounts receivable process management is a vital component of any business. In today’s world, many companies use accounting software to manage their accounts receivable or the money they owe to their clients. To help improve the financial health of their organizations, IT professionals can implement accounts receivable automation system that reduces their collection time and improves cash flow. Moreover, an automated system can boost a business’s net worth by reducing outstanding debts and collection costs. Furthermore, poor cash handling can lead to short-term financial problems if it causes clients to delay paying their dues. To avoid these issues, owners must take steps to improve their management of client accounts. The E-invoicing is an important component of Accounts receivable automation.

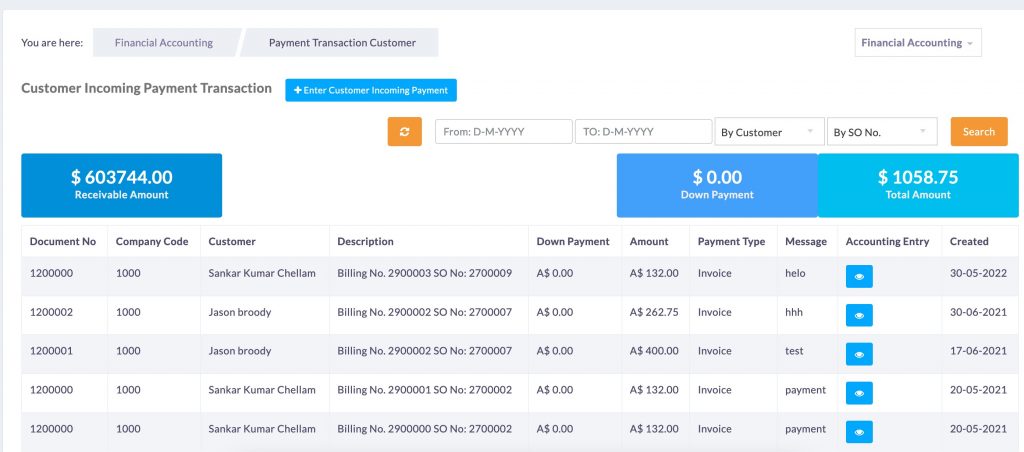

Accounts receivable systems allow businesses to determine their true net worth at any time. It is because current revenue is recorded in the system first, and deductions for outstanding invoices are made later. Conversely, under-recorded income leads some owners to believe they have more money than they do— a common problem in small businesses that aren’t able to track client payments accurately enough. An automated system reduces this issue by accurately recording all payments into firm coffers simultaneously, improving firms’ actual net worth. This approach also allows them to more efficiently plan for the cost of sales and investment activities and factor in interest and loan repayments from clients accordingly.The accounts receivable automation process is easier with OneBusiness ERP.

Effective cash handling is crucial when dealing with unpaid debts. It prevents financial troubles from occurring early in a business cycle. However, poor cash handling can cause clients to delay paying their invoices. To prevent this, owners must take steps to improve their handling of client payments through an automated system. Doing so will reduce collection times and avoid insolvency— improving businesses’ long-term profitability instead!

For more information please check our FB.